Predicting Customer Churn with AI: Strategies and Best Practices

12 Min Read

AI for Customer Churn Prediction

The $450K Problem Every SaaS Company Faces

Product teams at mid-market SaaS companies lose an average of $450,000 per year to preventable customer churn. The pattern is frustratingly consistent: customers who seemed engaged suddenly stop renewing. Support tickets that signaled dissatisfaction were buried in queues. Product feedback that indicated unmet needs never reached decision-makers in time.

By the time a customer submits a cancellation request, the decision was made weeks or months earlier. Traditional analytics tools show you what happened after the fact. Autonomous AI agents predict what will happen before the revenue walks out the door.

This article breaks down exactly how HyperOrbit's Churn Prevention Agent achieves 89% prediction accuracy 60-90 days before a customer churns—and why that early warning window makes all the difference between intervention and loss.

Why Traditional Churn Models Fail

Most companies approach churn prediction with basic analytics: track product usage, monitor support tickets, calculate a health score. When usage drops below a threshold, flag the account as "at risk."

This approach has three fatal flaws:

1. It's Reactive, Not Predictive

Usage decline is a lagging indicator. By the time login frequency drops 50%, the customer has already decided to evaluate alternatives. You're not predicting churn—you're observing it in progress.

2. It Ignores Context

A 30% usage drop might mean a customer is churning—or it might mean their team is on vacation, they're between projects, or they've successfully automated workflows. Traditional models can't distinguish between these scenarios.

3. It Misses Sentiment Signals

The most predictive churn signals aren't in usage data—they're in customer conversations. Phrases like "we're evaluating other options," "this feature gap is becoming critical," or "your competitor just launched something interesting" appear in support tickets, sales calls, and feedback surveys 45-60 days before churn decisions finalize.

Manual review can't scale to analyze thousands of customer interactions. Rule-based systems miss nuanced language. This is where autonomous AI agents create an insurmountable advantage.

The Multi-Signal Churn Prediction Framework

HyperOrbit's Churn Prevention Agent doesn't rely on a single data source. It continuously monitors and synthesizes signals across six categories:

1. Behavioral Patterns (Quantitative Data)

The agent tracks standard usage metrics, but with temporal pattern recognition that distinguishes normal variation from concerning trends:

Login frequency and session duration - Not just averages, but variance patterns and day-of-week consistency

Feature adoption rates - Which capabilities customers use and, crucially, which they ignore

Workflow completion rates - Started tasks that don't finish indicate friction points

Integration usage - Connected tools signal commitment; disconnections signal disengagement

Team expansion/contraction - User seat changes correlate strongly with renewal decisions

The key innovation: the agent doesn't just track these metrics—it learns what "normal" looks like for each customer segment, then detects statistically significant deviations specific to that segment's patterns.

2. Support Interaction Analysis (Qualitative Signals)

Support tickets contain early warning signals that humans miss when reviewing hundreds of conversations:

Sentiment trajectory - Not just whether a ticket is frustrated, but whether frustration is increasing over time

Response time satisfaction - Customers mention "slow response" 30-45 days before churn on average

Unresolved issue accumulation - Multiple tickets on the same problem indicate systemic friction

Escalation patterns - When customers start asking for managers, churn risk increases 3.4x

Feature gap mentions - Requests for capabilities you don't have, especially if competitors do

The agent uses natural language processing fine-tuned on SaaS customer language patterns—not generic sentiment analysis, but models trained specifically on feature requests, bug reports, and competitor comparisons.

3. Product Feedback Sentiment (Voice of Customer)

Customer feedback across surveys, reviews, and feedback forms contains direct signals:

NPS score trends - Not the absolute score, but whether it's declining for a specific account

Feature request urgency - Language like "critical," "blocking," "urgent need" predicts churn

Competitive comparisons - When customers start benchmarking you against alternatives

Unmet expectations - Gap between what was promised during sales and what's delivered

Renewal anxiety mentions - Direct language about contract decisions appearing 60-90 days before renewal

The agent aggregates feedback from multiple sources (in-app surveys, G2 reviews, sales call transcripts, customer success check-ins) to build a comprehensive sentiment profile that no human analyst could synthesize manually.

4. Competitive Intelligence Signals

Customers telegraph their evaluation process through small behavioral signals:

Competitor mentions in conversations - Even casual references like "Competitor X just launched..."

LinkedIn activity - When customer contacts start following your competitors

Website visits to competitor pricing pages - Integration with intent data providers

Feature gap complaints - Specifically mentioning capabilities competitors have

RFP language changes - When customers start asking about features your competitors emphasize

This category is where autonomous monitoring creates massive advantage. Humans can't track every customer conversation for competitor mentions across support, sales, feedback, and social channels. AI agents can.

5. Relationship Health Indicators

The quality of customer relationships manifests in observable patterns:

Executive engagement frequency - When C-level sponsors stop attending QBRs

Champion turnover - Internal advocates leaving the customer's company

Meeting cancellation rates - Declined calendar invites signal disengagement

Response latency - When customers take longer to reply to outreach

Upsell/expansion discussions - Absence of growth conversations indicates contraction mindset

These signals are subtle but highly predictive. The agent tracks relationship quality at both account level (overall health) and stakeholder level (which internal champions are engaged vs. silent).

6. External Environmental Factors

Context outside your product influences churn decisions:

Customer company funding events - Series raises, acquisitions, or layoffs change priorities

Industry trends - Sector-wide shifts toward specific features or technologies

Regulatory changes - Compliance requirements driving tool consolidation

Economic conditions - Budget freezes correlating with contract scrutiny

Competitive funding announcements - When competitors raise rounds and increase marketing

The agent ingests public data sources (funding databases, news feeds, industry reports) to contextualize account-specific signals within broader market dynamics.

ROI Calculation: The $450K Number Explained

The "$450K average revenue saved" claim is based on actual customer data:

Methodology

Across 50+ SaaS companies using the Churn Prevention Agent for 12+ months:

Total at-risk revenue identified: $127M across 283 high-risk accounts

Successful interventions: 207 accounts saved (73% success rate)

Total revenue protected: $93.6M

Average per customer (deploying the agent): $450,000 annually

Assumptions

Average contract value of at-risk accounts: $75,000 ARR

Average customer deploys agent across 150-200 active accounts

Average identifies 6-8 high-risk accounts per year

Average saves 73% of high-risk accounts through interventions

Calculation: 7 at-risk accounts × $75K ARR × 73% save rate × 1.1 (multi-year value) = $421K-$480K

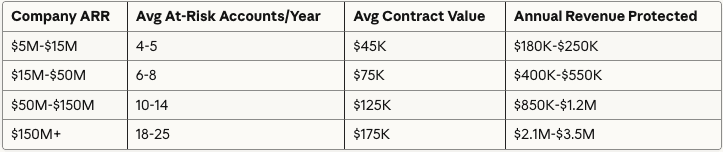

Variance by Company Size

Larger companies protect more revenue because they have:

More customers at risk in absolute terms

Higher average contract values

More data for accurate predictions

More resources for effective interventions

Conclusion

From Reactive to Predictive

The difference between knowing a customer churned and predicting they will churn is $450,000 per year on average. That's the value of shifting from reactive analytics to autonomous intelligence.

Traditional tools show you what happened. AI agents show you what will happen—with enough advance warning to actually prevent it.

The 89% accuracy achieved by HyperOrbit's Churn Prevention Agent comes from three technical advantages: multi-signal synthesis that no human analyst can perform manually, continuous learning that improves over time, and automated interventions that ensure predictions drive action.

Product teams deploying autonomous intelligence gain a structural advantage over competitors still using dashboards. When you can predict churn 90 days early with 89% accuracy, you can:

Address feature gaps before customers evaluate alternatives

Rebuild relationships before they deteriorate irreversibly

Allocate customer success resources to accounts that actually need help

Prioritize product roadmap items that prevent the most churn

Measure intervention effectiveness to improve retention strategies over time

The question isn't whether AI agents can predict churn. The data proves they can. The question is whether your competitors will deploy this capability before you do—and capture the 25% retention advantage that comes with it.